Table of Contents

Fixed deposits (FDs) remain one of the most dependable investment choices for Indian savers. Their appeal lies in guaranteed returns, simplicity, and insulation from market volatility. While equities and mutual funds fluctuate with market sentiment, fixed deposits offer certainty—investors know the exact return at the time of investment.

In 2025, fixed deposits have become particularly attractive due to sustained higher interest rates influenced by the Reserve Bank of India’s monetary stance. Banks across India have revised FD rates upward, making them a strong option for conservative investors, retirees, and anyone looking to balance riskier assets with stable income. This guide explains FD rates in depth, compares banks and tenures, and shows how to maximise returns while managing tax and liquidity concerns.

Overview of Fixed Deposits in 2025

A fixed deposit is a time-bound investment where a lump sum is deposited with a bank for a fixed tenure at a predetermined interest rate. The interest rate does not change during the investment period, regardless of market conditions. At maturity, investors receive the principal plus interest, either compounded or paid periodically.

In 2025, fixed deposits are widely used for short-term savings, retirement income planning, capital protection, and portfolio diversification. While inflation may reduce real returns over time, FDs continue to offer peace of mind, especially during economic uncertainty.

Fixed Deposit Overview Comparison

| Feature | Fixed Deposit |

|---|---|

| Risk Level | Very Low |

| Return Type | Guaranteed |

| Tenure Range | 7 days to 10 years |

| Liquidity | Medium |

| Best Suited For | Conservative investors, retirees |

Fixed Deposit Interest Rates by Bank Category

FD interest rates vary significantly depending on the type of bank. Public sector banks prioritise stability and trust, while private and small finance banks compete more aggressively on interest rates to attract deposits.

Understanding these differences helps investors align expectations with risk tolerance and return goals.

FD Rate Comparison by Bank Type (2025)

| Bank Category | Typical FD Rate (1–3 Years) | Safety Perception | Ideal For |

|---|---|---|---|

| Public Sector Banks | 6.25% – 6.90% | Very High | Capital protection |

| Private Sector Banks | 6.75% – 7.10% | High | Balanced risk and return |

| Small Finance Banks | 7.00% – 7.50% | Moderate | Higher returns within limits |

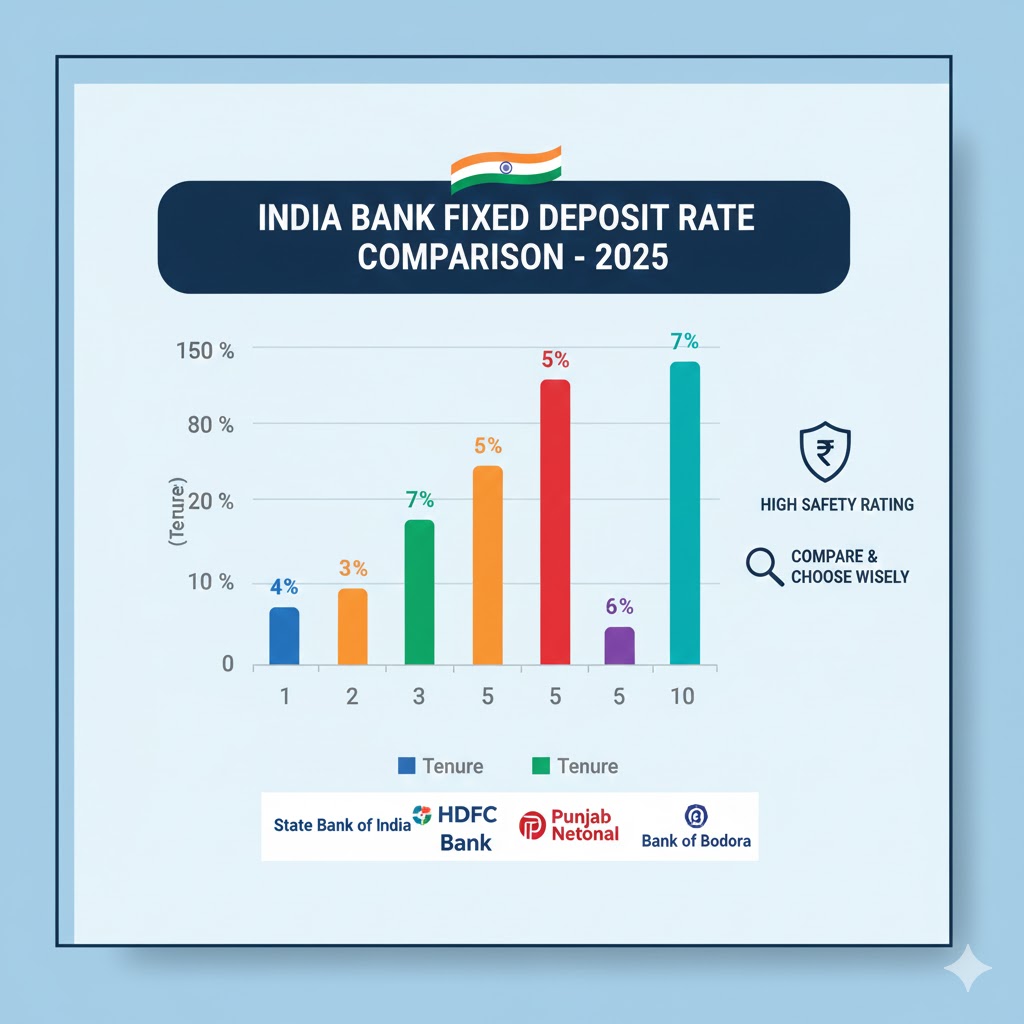

Top Banks and Their FD Rates for 2025

Leading banks in India offer competitive FD rates depending on tenure and deposit size. While rates change periodically, mid-range tenures (1–3 years) tend to offer the best balance between return and flexibility.

Private and small finance banks generally lead in interest rates, while large public banks provide reliability and nationwide service reach.

Popular Banks FD Rate Comparison (Indicative)

| Bank | Type | FD Rate Range | Senior Citizen Extra |

|---|---|---|---|

| State Bank of India | Public | 6.50% – 6.80% | +0.50% |

| HDFC Bank | Private | 6.75% – 7.00% | +0.50% |

| ICICI Bank | Private | 6.70% – 7.00% | +0.50% |

| Axis Bank | Private | 6.75% – 7.05% | +0.50% |

| Bandhan Bank | Small Finance | Up to 7.20% | +0.50% |

| RBL Bank | Private | Up to 7.20% | +0.50% |

Special Tenure Fixed Deposits

As of December 2025, banks across India are offering fixed deposit interest rates for tenures ranging from as short as 7 days to as long as 10 years. The rate offered depends on multiple variables, including the bank’s cost of funds, liquidity needs, and competitive positioning in the market.

Public sector banks generally offer lower but stable FD rates, appealing to investors who prioritise safety and long-term reliability. These banks are often backed by strong government ownership and inspire confidence among risk-averse depositors.

Private sector banks usually offer moderately higher rates, especially for mid-range tenures such as 1 to 3 years. Small finance banks, which rely heavily on deposits to fund lending, often provide the highest FD rates in the market. In many cases, their rates exceed those of large banks by 0.50% to 1.00%, making them attractive for return-focused investors.

Banks frequently introduce special-tenure fixed deposits, such as 444-day or 555-day FDs, which offer higher-than-normal interest rates for a limited period. These products are often launched during festive seasons or when banks need to quickly mobilise funds.

When comparing FD rates, investors should always check:

- Whether the quoted rate applies to cumulative or non-cumulative deposits

- If senior citizens receive an additional interest premium

- Whether the rate is applicable only for a limited period

- The minimum and maximum deposit thresholds

While higher interest rates can improve returns, they should never be the sole deciding factor. Financial stability, service quality, and ease of withdrawal are equally important.

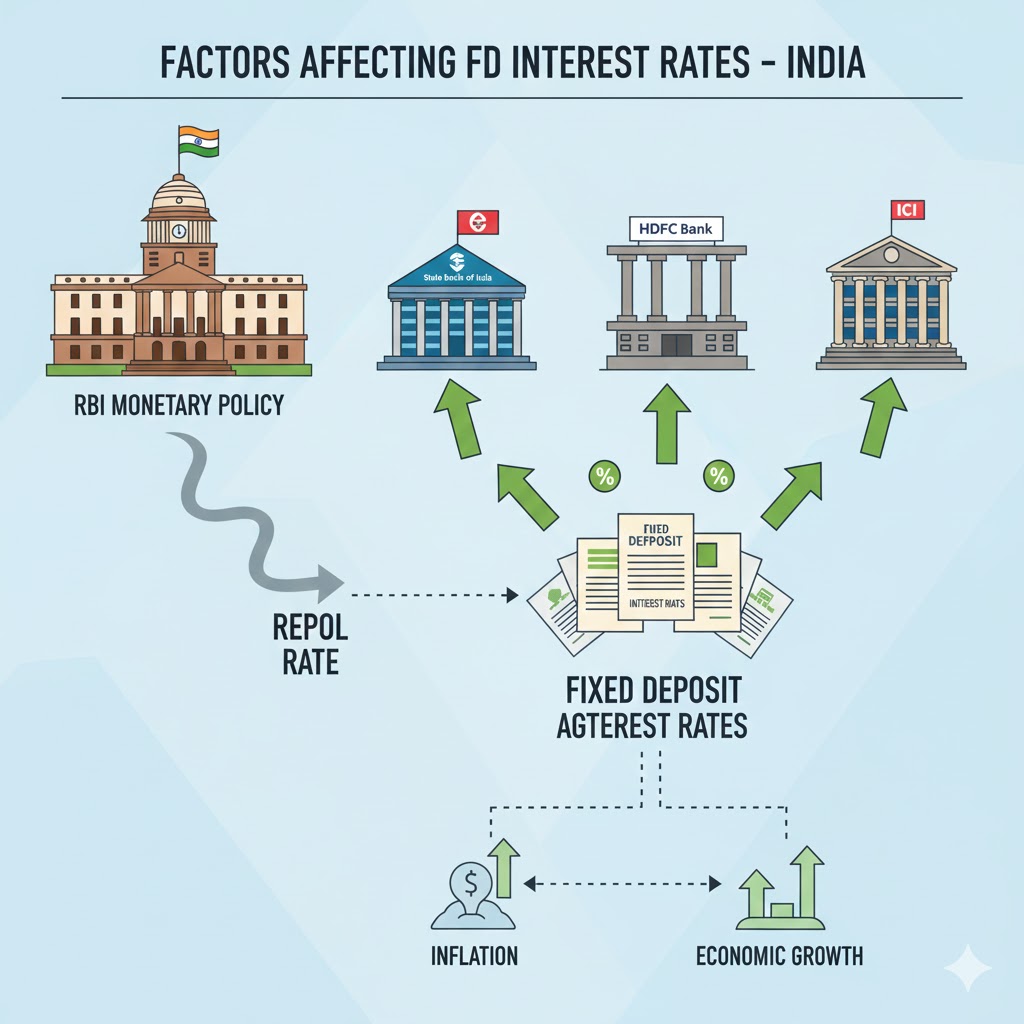

Fixed deposit interest rates are influenced by a combination of macroeconomic conditions and bank-specific factors. Understanding these drivers can help investors choose better timings and tenures for their deposits.

Tenure

Longer FD tenures usually offer higher interest rates because banks benefit from locked-in funds. However, this is not always the case. During periods of rising interest rates, banks may offer higher returns on shorter tenures to avoid committing to long-term payouts.

Deposit Amount

Most banks differentiate between retail deposits (generally below ₹2 crore) and bulk deposits. Retail investors often receive better rates, while large deposits may earn lower interest due to negotiated pricing.

Bank Category and Strategy

Public sector banks prioritise stability, while private and small finance banks compete aggressively on pricing. Small finance banks, in particular, use higher FD rates to attract deposits and expand their lending operations.

RBI Monetary Policy

Changes in the RBI’s repo rate have a direct impact on FD interest rates. When the RBI increases rates to control inflation, banks typically raise FD rates. Conversely, during rate-cut cycles, FD rates tend to decline for new deposits.

Standard vs Special Tenure FD Comparison

| Feature | Standard FD | Special Tenure FD |

|---|---|---|

| Tenure | Common durations | Unique durations |

| Interest Rate | Regular | Higher (limited period) |

| Availability | Year-round | Limited |

| Flexibility | Higher | Moderate |

Factors Affecting Fixed Deposit Interest Rates

FD interest rates are influenced by both economic and bank-specific factors. Understanding these elements helps investors choose the right time and tenure for investment.

Longer tenures usually offer higher rates, but during rising rate cycles, shorter tenures may be more advantageous. Deposit size, bank funding needs, and RBI repo rate changes all play a significant role.

Key Factors Influencing FD Rates

| Factor | Impact on Interest Rate |

|---|---|

| Tenure Length | Longer tenures often pay more |

| Deposit Amount | Retail deposits earn higher rates |

| Bank Liquidity Needs | Higher needs lead to better rates |

| RBI Repo Rate | Direct influence on FD pricing |

How to Choose the Best Fixed Deposit

Choosing the right fixed deposit requires balancing returns, safety, liquidity, and personal financial goals. Simply selecting the highest interest rate may not always be the best strategy.

A smart approach is to diversify deposits across multiple banks and tenures. FD laddering is a widely used technique where you split your investment into several FDs with different maturity dates. This provides regular liquidity and reduces reinvestment risk if interest rates fluctuate.

Investors should also carefully evaluate:

- The bank’s financial health and regulatory track record

- Deposit insurance coverage under DICGC

- Premature withdrawal penalties, which can reduce effective returns

- Availability of partial withdrawals or overdraft facilities

Cumulative FDs are best suited for long-term wealth accumulation, as interest compounds over time. Non-cumulative FDs, which pay interest monthly, quarterly, or annually, are more suitable for retirees and individuals seeking regular income.

FD Selection Criteria Comparison

| Criteria | Why It Matters |

|---|---|

| Interest Rate | Determines total return |

| Bank Stability | Protects principal |

| Tenure | Controls liquidity |

| Withdrawal Penalties | Affects flexibility |

| Deposit Insurance | Reduces risk |

Tax Implications of Fixed Deposits

Fixed deposit interest is fully taxable in India and is classified as “Income from Other Sources.” It is added to your total taxable income and taxed according to your applicable income tax slab.

Banks deduct Tax Deducted at Source (TDS) when FD interest exceeds ₹40,000 in a financial year, or ₹50,000 for senior citizens. TDS is deducted regardless of whether your total income is taxable, which is why eligible individuals should submit Form 15G or Form 15H to avoid unnecessary deductions.

Senior citizens benefit significantly from Section 80TTB, which allows a deduction of up to ₹50,000 on interest earned from bank and post office deposits. This provision makes FDs especially attractive for retirees.

For investors seeking tax efficiency, five-year tax-saving fixed deposits qualify for deductions under Section 80C. However, these FDs come with a mandatory lock-in period and do not allow premature withdrawal except in specific circumstances.

FD Tax Rules Comparison (2025)

| Tax Aspect | Rule |

|---|---|

| Interest Taxability | Fully taxable |

| TDS Threshold | ₹40,000 (₹50,000 for seniors) |

| Senior Deduction | ₹50,000 under Section 80TTB |

| Tax-Saving FD | Section 80C (5-year lock-in) |

Fixed Deposits vs Other Investment Options

Fixed deposits are best used as part of a diversified portfolio. While they offer safety and predictability, higher-return instruments may be needed to beat inflation over the long term.

Investment Comparison Table

| Investment | Risk | Returns | Liquidity |

|---|---|---|---|

| Fixed Deposit | Very Low | Moderate | Medium |

| Mutual Funds | Medium–High | High (variable) | High |

| Stocks | High | High | High |

| PPF | Very Low | Moderate | Low |

FAQs

Which bank offers the highest fixed deposit interest rate in December 2025?

Private banks and small finance banks generally offer the highest FD rates. In December 2025, institutions such as Bandhan Bank and RBL Bank are among the top providers for select tenures, especially for deposits between one and three years.

Are fixed deposit returns guaranteed in India?

Yes. Fixed deposits provide guaranteed returns as per the agreed interest rate at the time of booking. Additionally, deposits up to ₹5 lakh per bank per depositor are insured under the Deposit Insurance and Credit Guarantee Corporation (DICGC).

How can I maximise my fixed deposit returns?

You can maximise FD returns by comparing rates across banks, using FD laddering, choosing optimal tenures, taking advantage of senior-citizen benefits, and considering small finance banks while staying within insured limits.