Table of Contents

Equity mutual funds remain one of the most effective vehicles for long-term wealth creation in India. By investing primarily in shares of publicly listed companies, equity funds allow retail investors to participate in the country’s economic growth without needing to pick individual stocks. While equity investments can be volatile in the short term, history shows that disciplined, long-term investing in well-managed equity funds has consistently outperformed inflation and traditional fixed-income products.

In 2025, Indian equity markets are expected to benefit from stable macroeconomic fundamentals, improving corporate earnings, and increasing domestic participation through SIPs. However, not all equity funds perform equally across market cycles. Selecting the right funds—based on assets under management (AUM), consistency, portfolio quality, and fund management expertise—is critical.

This guide highlights the top equity mutual funds in India for 2025, explains how they differ, and helps you decide which type of fund best suits your financial goals.

Top Equity Mutual Funds in 2025 (Based on AUM)

Assets under management (AUM) is often used as a proxy for investor trust and fund stability. Large AUM usually indicates a proven investment process, operational efficiency, and long-term investor confidence. That said, AUM should always be evaluated alongside performance, risk management, and portfolio discipline.

Below are some of the largest and most consistently performing equity mutual funds in India across major categories.

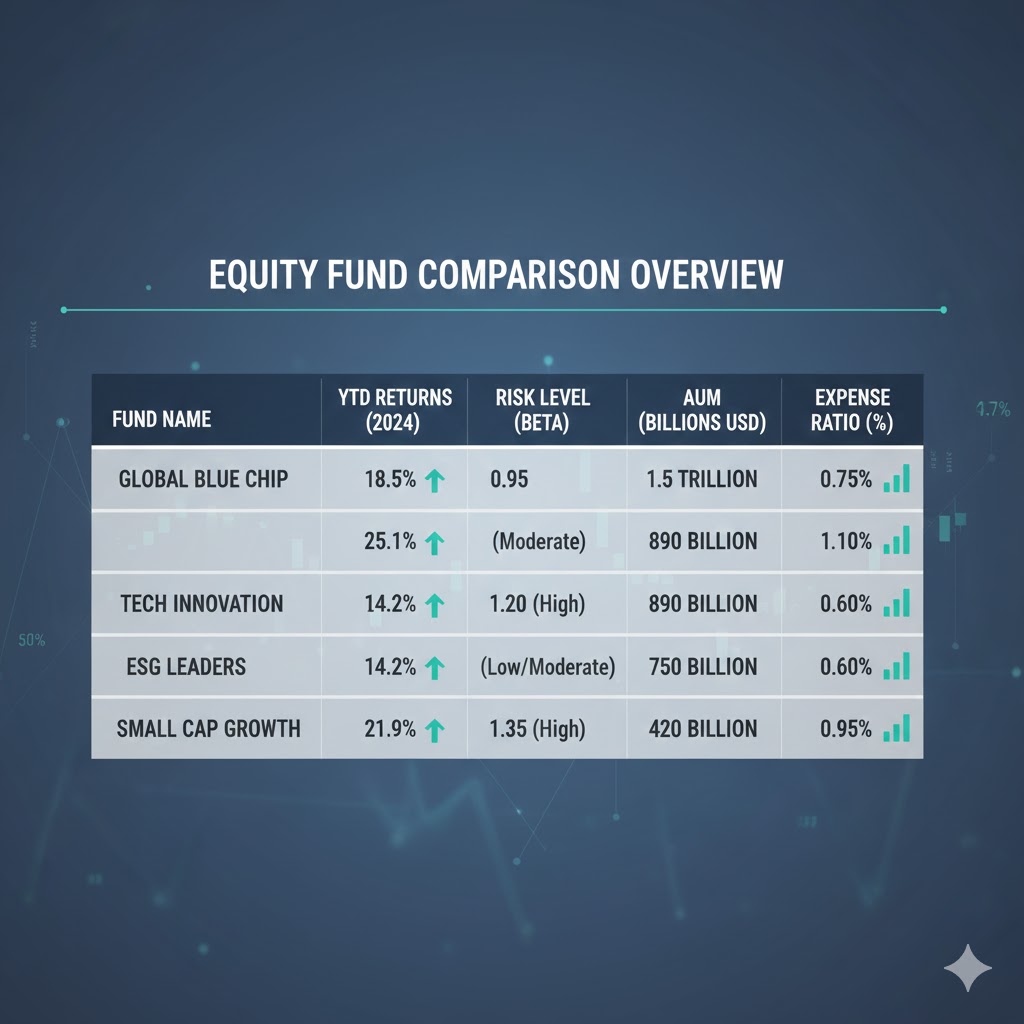

Key Fund Comparison (Overview)

| Fund Name | Category | AUM Size | Risk Level | Ideal Investor |

|---|---|---|---|---|

| Parag Parikh Flexi Cap Fund | Flexi Cap | Very Large | Moderate | Long-term diversified investors |

| HDFC Flexi Cap Fund | Flexi Cap | Very Large | Moderate–High | Core equity allocation |

| HDFC Mid Cap Fund | Mid Cap | Large | High | Growth-focused investors |

| ICICI Prudential Large Cap Fund | Large Cap | Large | Moderate | Conservative equity investors |

| Nippon India Small Cap Fund | Small Cap | Very Large | Very High | Aggressive long-term investors |

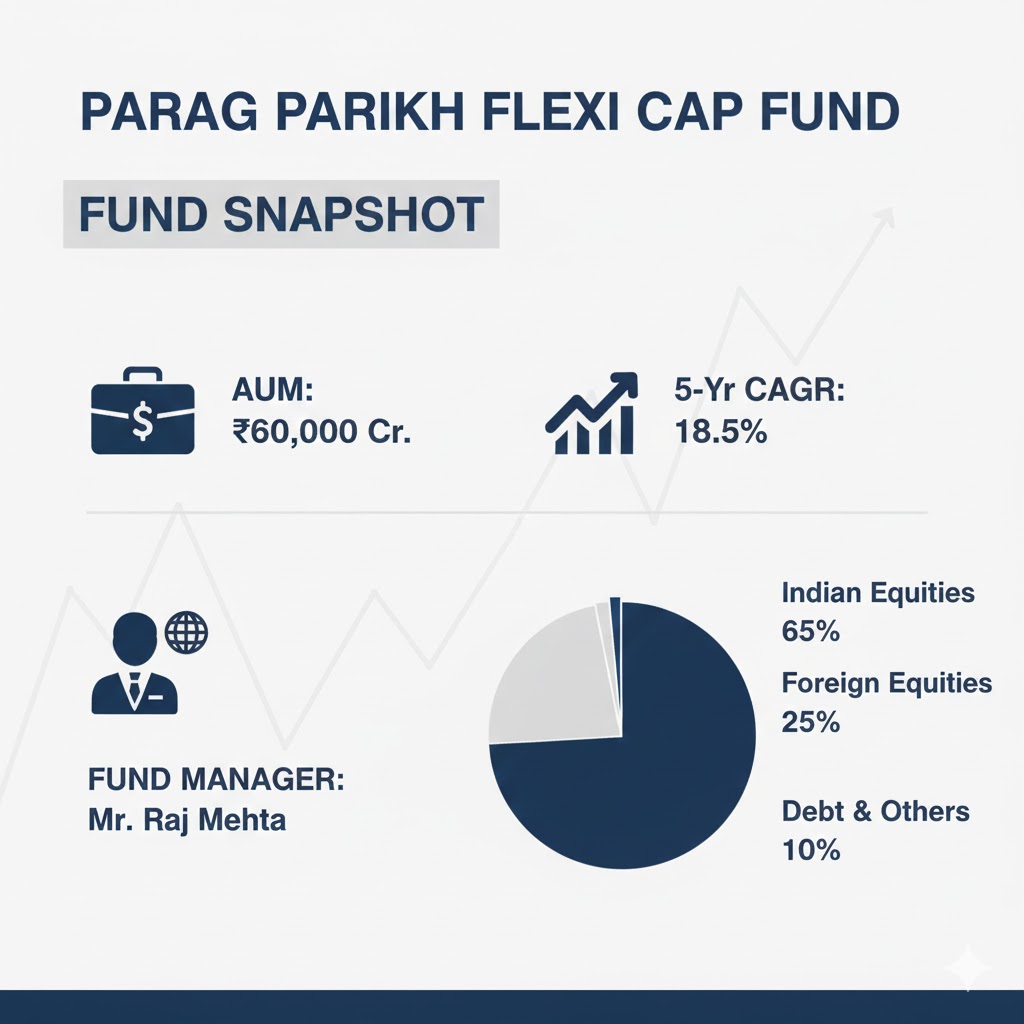

Parag Parikh Flexi Cap Fund

Parag Parikh Flexi Cap Fund is widely regarded as one of the most disciplined and investor-friendly equity funds in India. It invests across market capitalisations—large, mid, and small caps—and also allocates a portion of its portfolio to international equities, primarily US-listed companies. This global exposure helps reduce dependence on Indian market cycles.

The fund follows a value-oriented investment philosophy, focusing on high-quality businesses with strong balance sheets, predictable cash flows, and reasonable valuations. Its conservative approach has allowed it to limit downside risk during market corrections while still delivering competitive long-term returns.

Risk level: Moderate

Investment horizon: 5+ years

Fund Snapshot

| Metric | Details |

|---|---|

| Fund Type | Flexi Cap |

| Investment Style | Value-oriented, diversified |

| Volatility | Lower than category average |

| Time Horizon | 5+ years |

| Suitable For | Moderate-risk, long-term investors |

HDFC Flexi Cap Fund

HDFC Flexi Cap Fund is one of the oldest and largest flexi-cap schemes in India. The fund primarily invests in large-cap stocks but has the flexibility to increase exposure to mid- and small-cap companies when growth opportunities arise. This flexibility allows the fund to adapt to changing market conditions.

Backed by a large corpus and an experienced fund management team, the fund has delivered consistent returns across multiple market cycles. Its diversified portfolio and strong risk controls make it a core holding for many long-term investors.

Risk level: Moderate to moderately high

Investment horizon: 5–7 years

Fund Snapshot

| Metric | Details |

|---|---|

| Fund Type | Flexi Cap |

| Investment Focus | Large-cap dominant with flexibility |

| Volatility | Moderate |

| Time Horizon | 5–7 years |

| Suitable For | Investors seeking balanced growth |

HDFC Mid Cap Fund

HDFC Mid Cap Fund focuses on mid-sized companies that have the potential to become future market leaders. Mid-cap stocks typically offer higher growth potential than large-cap stocks but come with higher volatility, especially during market downturns.

The fund maintains a diversified portfolio across sectors and emphasises companies with strong earnings visibility and scalable business models. Over the long term, it has rewarded patient investors who stayed invested through market cycles.

Risk level: High

Investment horizon: 7+ years

Fund Snapshot

| Metric | Details |

|---|---|

| Fund Type | Mid Cap |

| Growth Potential | High |

| Volatility | High |

| Time Horizon | 7+ years |

| Suitable For | Growth-oriented investors |

ICICI Prudential Large Cap Fund

ICICI Prudential Large Cap Fund invests predominantly in established blue-chip companies with strong market positions and stable earnings. The fund aims to generate steady capital appreciation while managing downside risk during volatile market phases.

With a disciplined investment approach and a sizeable AUM, the fund has delivered returns that closely track or outperform its benchmark over long periods. It is often used as a relatively stable entry point into equity investing.

Risk level: Moderate

Investment horizon: 5+ years

Fund Snapshot

| Metric | Details |

|---|---|

| Fund Type | Large Cap |

| Investment Focus | Blue-chip companies |

| Volatility | Lower than mid/small caps |

| Time Horizon | 5+ years |

| Suitable For | Conservative equity investors |

Nippon India Small Cap Fund

Nippon India Small Cap Fund is one of the largest small-cap funds in India and has built a reputation for strong long-term performance. It invests in smaller companies with high growth potential, including emerging businesses that can benefit disproportionately during economic expansions.

Small-cap funds can experience sharp drawdowns during market corrections, but this fund’s diversified approach and active management have helped it recover strongly over time. It is best suited for investors who can tolerate significant volatility.

Risk level: Very high

Investment horizon: 8–10+ years

Fund Snapshot

| Metric | Details |

|---|---|

| Fund Type | Small Cap |

| Growth Potential | Very High |

| Volatility | Very High |

| Time Horizon | 8–10+ years |

| Suitable For | Aggressive long-term investors |

How to Evaluate Equity Mutual Funds

Choosing the right equity mutual fund requires more than reviewing recent returns. Investors should evaluate funds across qualitative and quantitative dimensions to ensure alignment with their financial goals.

Top Equity Mutual Funds (2025)

| Fund Name | Category | AUM Size | Risk Level | Suitable For |

|---|---|---|---|---|

| Parag Parikh Flexi Cap Fund | Flexi Cap | Very Large | Moderate | Long-term investors seeking diversification |

| HDFC Flexi Cap Fund | Flexi Cap | Very Large | Moderate–High | Core equity allocation |

| HDFC Mid Cap Fund | Mid Cap | Large | High | Growth-oriented investors |

| ICICI Prudential Large Cap Fund | Large Cap | Large | Moderate | Conservative equity investors |

| Nippon India Small Cap Fund | Small Cap | Very Large | Very High | Aggressive, long-term investors |

Which Equity Fund Type Is Right for You?

| Fund Category | Return Potential | Volatility | Ideal Investor Profile |

|---|---|---|---|

| Large Cap Funds | Moderate | Lower | First-time and conservative investors |

| Flexi Cap Funds | Moderate–High | Medium | Long-term investors seeking flexibility |

| Mid Cap Funds | High | High | Investors with higher risk tolerance |

| Small Cap Funds | Very High | Very High | Experienced investors with long horizons |

How to Evaluate Equity Mutual Funds Properly

When choosing an equity mutual fund, investors should avoid focusing solely on recent returns. Instead, consider the following factors holistically:

1. Investment Objective and Risk Alignment

Ensure the fund’s strategy aligns with your financial goals, time horizon, and emotional ability to handle market volatility.

2. Expense Ratio

Lower expense ratios improve net returns, especially over long investment periods due to compounding.

3. Portfolio Quality

Analyse sector allocation, stock concentration, and exposure to cyclical versus defensive industries.

4. Fund Manager Experience

Consistency under the same fund manager often indicates a stable and repeatable investment process.

5. Performance Across Market Cycles

Evaluate how the fund performed during bull markets, bear markets, and periods of economic stress.

6. Exit Load and Liquidity

Understand exit loads for early withdrawals and ensure the fund offers daily liquidity.

Evaluation Criteria Summary

| Factor | Why It Matters |

|---|---|

| Investment Objective | Ensures alignment with goals |

| Expense Ratio | Impacts long-term net returns |

| Portfolio Composition | Controls diversification and risk |

| Fund Manager Track Record | Indicates consistency |

| Benchmark Comparison | Measures true performance |

| Exit Load & Liquidity | Affects flexibility |

FAQs

Is a higher AUM always better?

Not necessarily. While a large AUM reflects investor confidence and stability, very large funds—especially mid- and small-cap funds—may face limitations in taking meaningful positions in smaller stocks. Process and discipline matter more than size alone.

Should I invest via SIP or lump sum?

SIPs are generally preferred for most investors as they reduce timing risk, encourage disciplined investing, and help smooth out market volatility over time.

Are small-cap funds safe for long-term investing?

Small-cap funds can deliver exceptional long-term returns, but they also come with sharp short-term fluctuations. They are suitable only for investors with long horizons, stable income, and high risk tolerance.