Table of Contents

Interest rates in New Zealand influence everything from home loans and business borrowing to savings returns and national economic performance. Understanding how the Reserve Bank of New Zealand (RBNZ) adjusts the Official Cash Rate (OCR), and how commercial banks respond, is essential for anyone navigating the country’s financial landscape—whether you’re securing a mortgage, refinancing debt, or planning long-term investments. More NZ financing solutions.

This comprehensive guide explores how interest rates work in NZ, key factors driving rate changes, market forecasts, and what Kiwis can expect over the coming years. It is tailored to New Zealand’s unique economic environment and integrates relevant internal references such as the New Zealand Finance sitemap for deeper navigation.

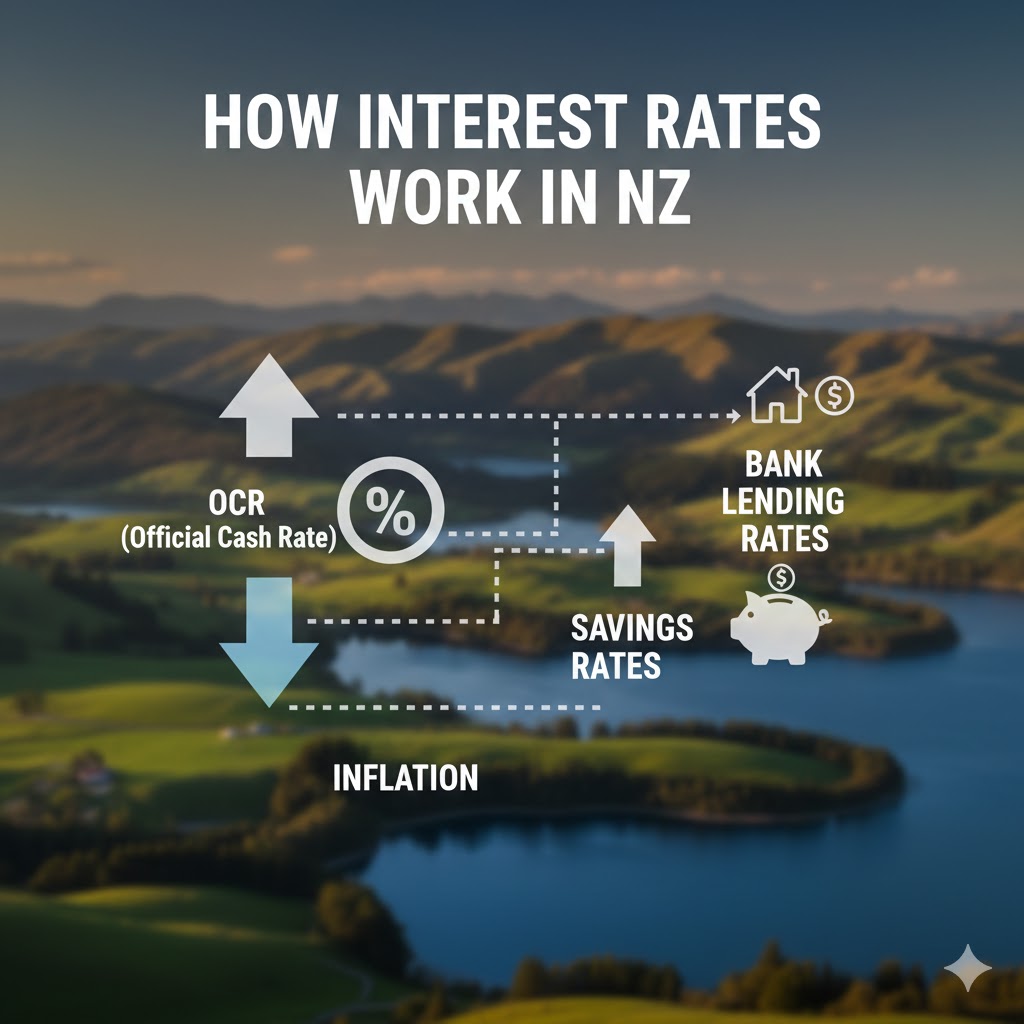

How Interest Rates Work in New Zealand

Interest rates in New Zealand primarily revolve around the Official Cash Rate (OCR), set by the Reserve Bank. The OCR influences the cost of borrowing across the economy and ultimately affects mortgage rates, business lending, term deposits, and government bonds.

When inflation is high, the RBNZ typically increases the OCR to cool economic demand. Conversely, when the economy slows, the OCR may be lowered to encourage borrowing and spending.

📊 Chart: OCR Impact on Bank Lending Rates

The Role of the Reserve Bank of New Zealand (RBNZ)

The RBNZ’s mandate includes maintaining price stability and supporting maximum sustainable employment. Interest rate decisions are made during Monetary Policy Statements, released several times per year.

These decisions directly influence residential mortgage pricing—floating rates adjust rapidly, while fixed rates depend more on wholesale market expectations for future OCR levels.

📊 Chart: Historical OCR Trends in New Zealand

Current Interest Rate Trends in NZ

As of 2025, New Zealand’s interest rates remain elevated following a period of inflationary pressure. The RBNZ has signalled a more cautious approach, maintaining a restrictive stance until inflation returns to the target band of 1–3%.

Banks are offering a mix of competitive fixed-rate mortgage terms as global pressures ease. However, floating rates remain high due to continued monetary tightening in previous quarters.

📊 Chart: Fixed vs Floating Rate Movements

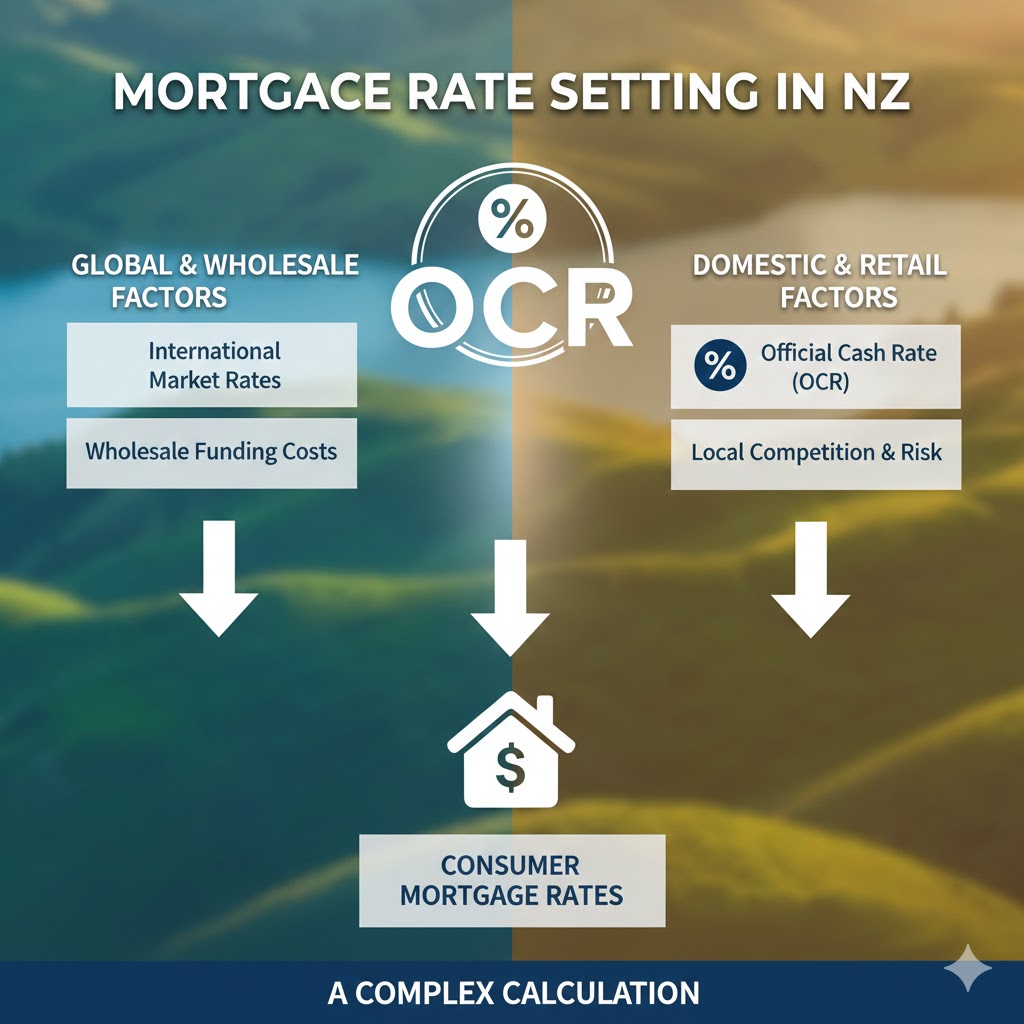

How NZ Mortgage Rates Are Set

Mortgage rates in New Zealand are heavily influenced by the OCR and wholesale bond yields. Fixed home loan rates tend to reflect long-term economic expectations, while floating rates react to immediate OCR movements.

Borrowers often choose a mix of fixed and floating rates to balance predictability with flexibility. Many Kiwis also explore refinancing opportunities when the OCR drops, as this can significantly reduce loan costs over the life of a mortgage.

📊 Chart: Mortgage Rate Components Breakdown

Economic Factors That Influence NZ Interest Rates

New Zealand’s interest rates are shaped by a combination of domestic and international forces. Beyond inflation, key drivers include wage growth, housing market activity, global supply chain pressures, and geopolitical influences on commodity prices.

For example, disruptions in global shipping or changes in oil prices can increase import costs, leading to inflationary pressure. Similarly, strong migration inflows can stimulate housing demand, indirectly affecting mortgage rates.

📊 Chart: NZ Inflation vs OCR Comparison

Future Outlook: Where NZ Interest Rates Are Headed

Forecasts for 2025–2027 suggest New Zealand may see gradual rate easing once inflation stabilises. Analysts expect the OCR to decrease moderately as global demand softens and domestic price pressures diminish.

However, uncertainty remains due to international conflicts, commodity volatility, and fluctuating consumer sentiment. Kiwis should continue monitoring Monetary Policy Statement updates and understanding how rate shifts may affect long-term borrowing decisions.

📊 Chart: NZ Interest Rate Forecast 2025–2027

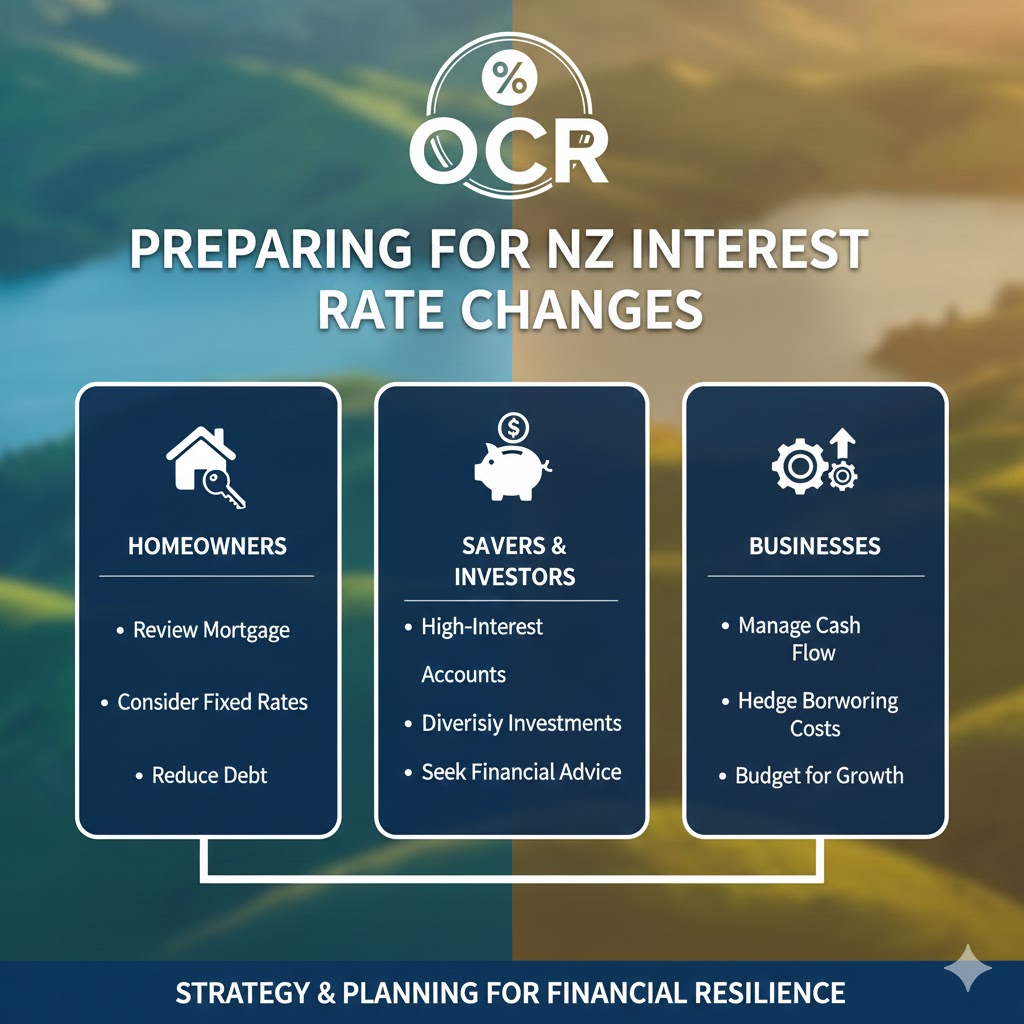

How NZ Borrowers Can Prepare for Rate Changes

With interest rate movements affecting household budgets, preparing strategically is essential. Borrowers can use tools such as repayment calculators, fixed-rate locks, and refinancing options to reduce financial stress.

Additionally, diversifying debt structures—such as splitting mortgages across multiple fixed terms—can protect against sudden rate increases.

📊 Chart: Household Debt vs Interest Rate Pressure

Where to Find the Latest NZ Interest Rate Information

Keeping up to date with the latest interest rate news is easier than ever. Resources include the RBNZ website, major New Zealand banks, and financial comparison tools. Additionally, you can explore the internal New Zealand Finance sitemap for more detailed insights.

Whether you’re planning a property purchase, considering refinancing, or managing business financing, reliable NZ-specific information is essential for making informed decisions.

📊 Chart: NZ Banks – Rate Update Frequency Comparison