Table of Contents

At its heart, refinancing your home loan in NZ is simply replacing your current mortgage with a new one. It’s a strategic financial move, usually done to get a better deal with a different lender, lower your interest rate, or tap into the equity you’ve built up in your home.

What Is Refinancing and Why Consider It in NZ

Think of your home loan like your power plan. When you first signed up, you probably got the best rate available at the time. But fast forward a few years, and new deals and more competitive providers have popped up. If you just stick with your original plan out of habit, you could be leaving serious money on the table.

Refinancing works on the same principle. You’re taking out a new mortgage—either with your existing bank or a new one—to pay off and close your old loan. The goal is simple: secure a new loan that fits your life and financial goals today. This isn’t just about chasing the lowest interest rate you see advertised; it’s a powerful opportunity to rethink and fine-tune your single biggest financial commitment.

Why Kiwi Homeowners Choose to Refinance

The reasons people refinance are pretty varied, but they almost always boil down to improving their financial position. It’s a proactive strategy that has become incredibly popular, especially in the recent market.

Just look at the numbers from June 2025—it was a historic month for refinancing. Over 3,500 borrowers switched lenders, moving around $2.5 billion in loans. That wave accounted for a record 30% of all new mortgage commitments for the month, showing just how many Kiwis are using refinancing as a key financial tool. You can read more about recent refinancing trends in New Zealand to see the full picture. Learn more about NZ company standings.

So, why are so many people looking for a refinance home loan NZ deal? Here’s a quick rundown of the main drivers.

| Motivation | Potential Outcome |

|---|---|

| Get a Lower Interest Rate | Reduce your monthly repayments and save thousands over the life of the loan. |

| Consolidate Debt | Roll high-interest credit card or personal loan debt into your new, lower-rate mortgage. |

| Unlock Home Equity | Borrow against your home’s increased value to fund renovations or other big purchases. |

| Change Loan Structure | Switch from a variable to a fixed rate, shorten your loan term, or add features like an offset account. |

This table shows the most common reasons Kiwis decide to make a change. Each one is about making your mortgage more flexible and better suited to your needs.

Ultimately, it’s all about putting your mortgage back to work for you.

Refinancing is about ensuring your mortgage serves your goals, not the other way around. It’s an opportunity to adapt to changes in your life, your finances, and the market.

Weighing the Pros and Cons of Refinancing

Deciding whether to refinance your home loan in NZ is a classic balancing act. The promise of big savings is definitely tempting, but it’s crucial to look at the full picture—both the powerful advantages and the potential pitfalls.

Think of it like trading in your car. Sure, you could get a newer model with better fuel efficiency and shinier features, but you also have to factor in the trade-in value, the paperwork, and the cost to upgrade. A successful refinance is no different; it needs to genuinely improve your financial situation, not just shuffle the deck chairs.

The Upside: Potential Benefits of Refinancing

The most obvious win is locking in a lower interest rate. A better rate can slash your monthly repayments and save you tens of thousands of dollars over the life of your mortgage. But the perks don’t stop there.

Many Kiwis also use refinancing as a chance to grab a cashback offer from a new lender. These lump-sum payments can be a huge help, often providing thousands of dollars to cover your legal fees with plenty left over.

Beyond that, refinancing is your chance to get a loan structure that actually fits your life now. You could:

- Shorten your loan term: Get mortgage-free faster by switching to a shorter term, which also means you build equity in your home much quicker.

- Consolidate high-interest debt: Got credit card or personal loan debt hanging around? You can roll it into your mortgage to get one simple, lower-rate repayment.

- Access better features: Your current bank might not offer useful tools like an offset account or a revolving credit facility. A new lender might.

Refinancing isn’t just a transaction; it’s a strategic review of your largest financial commitment. It’s your opportunity to restructure your debt to better serve your current needs and future ambitions.

The Downside: Potential Drawbacks and Hurdles

While the benefits are compelling, refinancing isn’t a walk in the park. It takes time, effort, and money, so you need to go in with your eyes wide open.

For starters, you’re essentially applying for a brand-new loan. That means paperwork—payslips, bank statements, the works. It’s a bit of a hassle, but a necessary step to prove you can service the new loan.

You might also need a new valuation on your property. If your home’s value has dipped since you first got your mortgage, it could push up your Loan-to-Value Ratio (LVR), making it harder to qualify for the sharpest rates.

And finally, there are the direct costs you can’t ignore:

- Legal Fees: You’ll need a solicitor to handle the switch, which typically costs between $1,500 and $2,000.

- Break Fees: If you’re on a fixed rate, breaking it early can trigger a hefty early repayment charge from your current bank.

- Clawbacks: Got a cashback from your bank when you first signed up? If you leave within the clawback period (usually three or four years), you might have to pay some of it back.

Understanding these pros and cons is the first step. The goal is to make sure the long-term savings and benefits will comfortably outweigh the upfront costs and effort required to refinance your home loan in NZ.

Calculating the True Cost to Refinance Your Loan

Before you start picturing what you’ll do with the savings from a lower interest rate, you need to get real about the upfront costs. A great refinancing deal isn’t just about the new rate; it’s about making sure the long-term gains comfortably beat the initial expenses. Getting your head around the real costs of refinancing your home loan is the only way to know if you’re making a smart financial move.

Think of it like booking a cheap flight. The headline price looks amazing, but once you add baggage fees, seat selection, and a credit card surcharge, it’s not such a bargain anymore. Refinancing can be the same. You have to look past the shiny new interest rate to see the full financial picture.

Identifying the Key Refinancing Costs

When you refinance your home loan in NZ, a few different fees can pop up. Some banks throw in cashback offers that can help soften the blow, but it’s still crucial to know what you’re up for. The main costs you’ll likely run into are break fees, legal fees, and sometimes a valuation fee.

- Break Fees: This is often the biggest deal-breaker. If you’re on a fixed-rate mortgage, your current bank will charge you for breaking your contract early.

- Legal Fees: You’ll need a solicitor to handle the paperwork to move your mortgage from one bank to another. This typically costs somewhere between $1,500 and $2,000.

- Valuation Fees: Your new lender might want an up-to-date valuation of your property to confirm what it’s worth. This can set you back a few hundred dollars.

- Application Fees: These are less common these days, but some lenders might still charge a fee to process your application.

Knowing these costs is the first step to figuring out if making the switch is actually worth it.

Demystifying the Dreaded Break Fee

The most significant—and often most confusing—cost is the break fee, also called an early repayment charge. Banks charge this to make up for the interest they lose out on when you ditch your fixed-term contract before it’s up.

So, how do they work it out? It’s basically a comparison between the interest rate you locked in and the current wholesale interest rates for the time you have left on your term. If market rates have dropped since you fixed your loan, your break fee will probably be higher. If rates have gone up, your fee could be small or even nothing at all.

Your bank can give you an exact break fee calculation if you ask for it. This number is non-negotiable for your calculations, so don’t just guess—get the precise figure before you make any moves.

Running a Break-Even Analysis

Once you have a handle on the total upfront costs, you can do a quick break-even analysis. This simple calculation shows you exactly how long it will take for your monthly savings to cover the initial cost of refinancing. After that point, every dollar you save is pure gain.

Let’s run through a simple example.

Hypothetical Refinance Scenario:

Upfront Costs:

- Break Fee: $4,000

- Legal Fees: $1,800

- Valuation Fee: $0 (your new lender waived it—nice!)

- Total Costs: $5,800

Monthly Savings:

- Old Monthly Repayment: $3,200

- New Monthly Repayment (with lower rate): $2,950

- Total Monthly Savings: $250

Now for the easy part—the break-even calculation.

Break-Even Calculation:

Total Costs ($5,800) ÷ Monthly Savings ($250) = 23.2 months

In this scenario, it would take just over 23 months of lower repayments to pay off the cost of refinancing. If you’re planning to stay in your home for longer than two years, making the switch is a clear financial win. This simple piece of maths gives you a solid, data-driven answer on whether to go for it.

How to Know When It Is the Right Time to Refinance

Timing your refinance is a bit like surfing—you need to catch the right wave to get the best ride. Move at the right moment, and the savings can be huge. Get it wrong, and you could end up paying for it.

The secret is learning to spot the triggers. These are signals that it’s time to at least review your mortgage, and they fall into two camps: things happening in your own life, and shifts in the wider market. Understanding both will help you find that perfect window to make your move.

Personal Life Triggers for a Mortgage Review

Your life doesn’t stand still, so why should your mortgage? Certain personal events create a natural opportunity to check in on your home loan and make sure it still fits.

Here are the most common personal triggers:

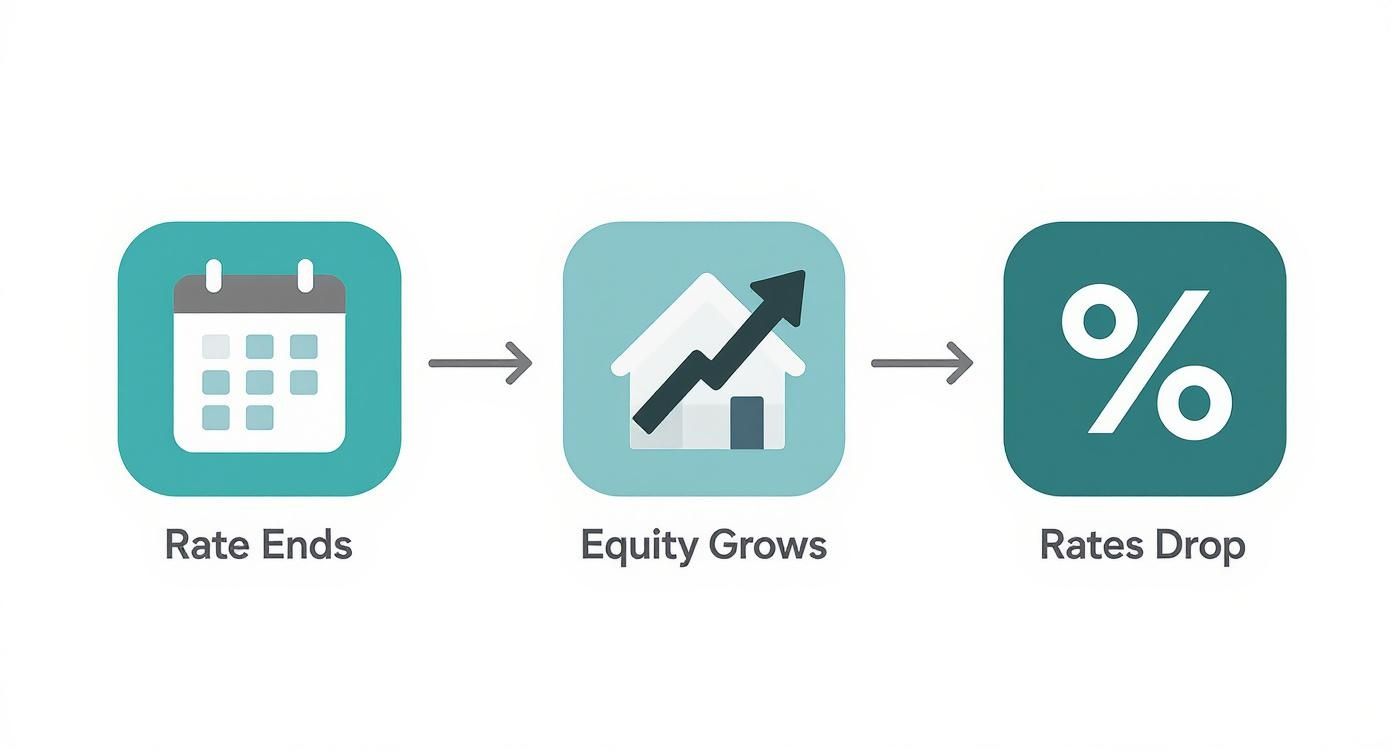

- Your Fixed-Rate Period is Ending: This is the big one. As your fixed term wraps up, you’re free to switch lenders without facing nasty break fees. It’s the single best time to shop around for a better deal.

- A Significant Change in Income: Landed a pay rise or a great new job? That extra income could help you qualify for a much better loan or allow you to make higher repayments and clear your mortgage years sooner.

- You Need Funds for a Big Project: Planning a major renovation, helping fund the kids’ education, or finally buying that dream car? Refinancing lets you tap into your home’s equity, giving you cash at a much lower interest rate than any personal loan.

Think of these life events as a financial check-up for your mortgage. They’re perfect moments to pause and ask, “Is my current home loan still the best option for me?”

Market-Driven Refinancing Opportunities

Beyond what’s happening in your world, the broader economic climate plays a massive role. A crucial part of timing your refinance is understanding how interest rates shape your property journey and reading the market cues. When banks start fighting for your business, it’s a great time to be a borrower.

Market shifts created excellent opportunities for homeowners in 2025. For example, when the Reserve Bank cut the Official Cash Rate, it triggered falling interest rates and improved affordability, with first-home buyers making up 26% of purchases in the second quarter.

These market-driven opportunities often include:

- Falling Interest Rates: When the Reserve Bank of New Zealand (RBNZ) lowers the Official Cash Rate (OCR), mortgage rates almost always follow. This is a prime time to lock in a lower rate and slash your repayments.

- Aggressive Cashback Offers: To win new customers, banks often dangle thousands of dollars in cash offers. These deals can easily cover your legal fees and leave you with extra money in your pocket.

- You’ve Built Significant Equity: As you pay down your loan and your property’s value goes up, your Loan-to-Value Ratio (LVR) drops. Once your LVR is below 80% (meaning you officially own more than 20% of your home), you become a top-tier borrower who can access the very best interest rates on the market.

A Step-by-Step Guide to the Refinancing Process

Ready to see if you can get a better deal on your mortgage? Knowing what’s involved can make the whole idea of refinancing your home loan in NZ feel a lot less intimidating. We’ve broken the journey down into clear, manageable stages, turning a complex financial process into a simple checklist.

Think of it like planning a road trip. You wouldn’t just jump in the car; you’d check your vehicle is in good shape, map out the route, and figure out what to pack. Refinancing works the same way—a bit of prep and a clear roadmap ensures you get where you want to go without any nasty surprises.

Stage 1: Assess Your Current Position and Goals

Before you even think about looking at other lenders, your first job is to get a crystal-clear picture of where you stand right now. This is the foundation for making a smart decision.

Start by asking yourself a few honest questions to figure out what you’re actually trying to achieve.

- What’s my current interest rate and loan structure? You need to know exactly what you’re paying and whether your loan is fixed, floating, or a bit of both.

- What are my financial goals? Are you trying to slash your monthly payments? Pay the mortgage off faster? Or maybe unlock some equity for that long-overdue renovation? Be specific.

- When does my current fixed term end? This one is critical for avoiding expensive break fees. The sweet spot for switching is nearly always just as your current term is about to mature.

Nailing down these goals gives you a compass. It guides you toward the right type of loan and the right lender, ensuring you’re not just chasing the lowest advertised rate but finding a solution that genuinely improves your financial situation.

This infographic highlights the common triggers that signal it might be the perfect time to start looking.

As you can see, the ideal window to refinance often opens when personal timing (like your fixed rate ending) lines up with what’s happening in the market.

Stage 2: Research Lenders and Prepare Your Documents

With your goals set, it’s time to see what’s out there. You can start by researching interest rates and cashback deals online, but this is also where a good mortgage adviser can be worth their weight in gold. They have relationships with multiple lenders and can quickly pinpoint the best options for your specific circumstances.

Once you’re ready to move forward, you’ll need to gather your financial documents. This is the most admin-heavy part of the whole process, but getting organised now will save you a ton of hassle later. You’re essentially applying for a new loan from scratch, so the new lender needs to be confident you’re in a stable financial position.

Preparing your paperwork in advance is the single best way to speed up your application. An organised file shows the lender you’re a serious and reliable borrower, which can help your application get to the top of the pile.

Getting your documents in order before you apply is a game-changer. Your lender or adviser will give you a specific list, but here’s a rundown of what they’ll typically ask for to streamline the process.

Refinancing Application Document Checklist

| Document Type | What to Prepare |

|---|---|

| Proof of Identity | Your passport or NZ driver licence. |

| Proof of Income | Recent payslips. If you’re self-employed, you’ll need your last two years of financial statements. |

| Bank Statements | Typically the last three months of statements for all your day-to-day accounts to show spending habits. |

| Existing Loan Details | Statements for your current mortgage and any other debts like personal loans, credit cards, or car finance. |

| Property Information | A recent council rates notice is usually enough. They’ll also need to know your home insurance details. |

Having these ready to go shows the bank you’re organised and makes their job much easier, which always works in your favour.

Stage 3: Application and Approval

After submitting your application and all that paperwork, your file goes to the new lender for assessment. Their credit team will dive into your financial position to make sure you can comfortably handle the new loan repayments. This is where your good preparation really pays off—a complete, well-organised application can be processed much faster.

Bank turnaround times can vary a lot, but allowing for around 10 working days is a safe bet.

If your application gets the green light, you’ll receive a conditional offer. This approval might be subject to a few conditions, like a satisfactory property valuation. The lender will organise this if they need one, and once all their boxes are ticked, you’ll get your unconditional offer.

Stage 4: Legal Work and Final Settlement

With an unconditional offer in hand, the finish line is in sight! The final step is the legal work. You’ll need a solicitor to handle the “discharge” of your old mortgage and the registration of the new one. They will go through the new loan documents with you, make sure you understand all the terms, and witness your signature.

Your solicitor then coordinates with both your old and new lenders to lock in a settlement date. On this day, the new bank officially pays off your old mortgage, and your refinancing is complete. Your automatic payments will be switched over to the new lender, and you can start enjoying the benefits of your new loan. Congratulations

So, where does that leave you?

You’ve now got a solid grasp of how refinancing works in New Zealand. The big takeaway here is that refinancing isn’t just about chasing the lowest interest rate advertised on TV. It’s a strategic move designed to make your biggest asset—your home—work much smarter for you.

Ultimately, the right decision comes down to your personal situation and what you want to achieve long-term. Before you jump in, take a moment to think about your goals. Are you trying to smash down your mortgage faster? Or maybe you just need a bit more breathing room in your monthly budget? Perhaps you’re looking to pull out some equity to finally get that new kitchen sorted. Whatever it is, aligning your refinancing plan with that goal is the most important step you’ll take.

Your Next Move

Armed with this knowledge, you’re in a great position to decide what to do next. Your path forward really depends on how confident you feel and how complex your finances are.

- Chat with Your Current Bank: The first port of call is often the easiest. Give them a buzz and ask if they can sharpen their pencil to keep you as a customer. You might be surprised what they can offer.

- Do Some Window Shopping: Jump online and use a few comparison sites. See what other lenders are offering in terms of rates and, just as importantly, any cashback deals that could sweeten the pot.

- Talk to a Mortgage Adviser: If you want someone in your corner, an adviser can be a game-changer. They’ll compare dozens of lenders for you, handle the paperwork, and find a deal that genuinely fits your circumstances.

At the end of the day, a successful refinance is about more than just numbers on a page. It’s about setting up a financial structure that supports your life, cuts down on stress, and gets you closer to where you want to be.

Whether you decide to stick with your current lender, make the switch, or bring in an expert, you now have the tools to make a smart, informed choice. You’re in the driver’s seat of your financial future, ready to make a call that will benefit you for years to come.

Common Questions About Home Loan Refinancing

Even with a solid plan, it’s completely normal to have a few questions rattling around when you’re thinking about a move as big as refinancing your home loan. We get asked these all the time, so we’ve put together some straight-up answers to help you fill in any gaps.

Think of it like the final check before a long road trip. You’ve mapped the route and checked the engine; now it’s just about making sure you haven’t forgotten anything important.

How Long Does the Refinancing Process Take?

This is probably the number one question we hear. While every situation has its own quirks, a standard refinance in New Zealand usually takes between four to six weeks from when you first apply to settlement day.

A few things can stretch that timeline out:

- Lender Turnaround Times: Let’s be honest, some banks are just faster than others. If you apply during a busy period, it’s wise to add an extra week or two to your expectations.

- Your Preparation: Having all your documents ready to go from day one is the single biggest thing you can do to speed things up.

- Valuation Requirements: If the new lender wants a full property valuation done, that can add a few extra days to the schedule.

The key is to start looking into it well before your current fixed rate ends. The last thing you want is to be rushed into a decision.

A smooth refinancing journey is all about good timing and preparation. Aim to begin your research about two months before your fixed rate is due to expire to give yourself plenty of breathing room.

Can I Refinance With an Imperfect Credit History?

Yes, it’s often possible to refinance even if your credit score isn’t sparkling, but it definitely makes things a bit tougher. The main banks have pretty strict lending criteria, and a history of missed payments or defaults can be a red flag for them.

Don’t assume it’s a closed door, though. Your chances get a lot better if you can show you’ve had a solid run of consistent payments and responsible financial habits recently. A mortgage adviser can be a huge asset here—they know which lenders are more flexible and can help frame your application in the best possible light.

Is It Possible to Add or Remove Someone From the Mortgage?

Absolutely. Refinancing is the perfect opportunity to make changes to who is on the property title and the mortgage. It’s a common step for people going through a separation, or on the flip side, for those bringing a new partner onto the loan.

This does involve a bit more legal legwork, as it usually requires a sale and purchase agreement to formally handle the ownership transfer. Crucially, the person staying on (or being added to) the loan has to prove they can service the entire mortgage on their own income.

- Adding Someone: The lender will look at your combined income and financial situation to approve the new loan structure.

- Removing Someone: The lender needs to be completely satisfied that the remaining borrower earns enough to handle the mortgage repayments solo.

Your solicitor will manage the legal side of this during the settlement, making sure the property title is updated correctly to reflect the new ownership. It makes the refinance home loan NZ process an ideal time to get your mortgage aligned with where you’re at in life.

Ready to explore your options and see if you could get a better deal on your home loan? The team at Newzeland Finance provides the tools and guides you need to compare lenders and make a smart decision. Visit us at https://newzealand-finance.nz to start your journey.